Your money. Your family. Your credit union.

Free Checking Account

Access your account wherever and whenever with a CAMPUS Free Checking Account¹. It's free, easy and convenient!

- No Monthly Fee with no minimum balance requirement¹

- CAMPUS Online & Mobile Banking with Mobile Deposit

- Early Pay - receive your paycheck up to 2 days sooner²

- Online Bill Pay

- Instant-Issue Debit Cards: choose one of our exclusive debit card designs

- Debit Card Courtesy Pay: Elect to set your debit card up on Courtesy Pay, our discretionary overdraft program, which provides coverage of everyday debit card transactions due to insufficient funds

- Free CAMPUS and Publix Presto! ATMs

- Send money with Zelle®, an easy and free³ way to send money to friends and family.

- Financial Tools, in CAMPUS Online and Mobile Banking, a management tool to help you track spending, budgets, and set goals.

1. Credit approval and a $5 opening deposit to a savings account is required. Member must elect to receive eDocuments. 2. Direct deposit paychecks made through ACH could be available up to two days before the scheduled payment date. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit. 3. To send or receive money with Zelle®, both parties must have an eligible checking or savings account. Transactions between enrolled users typically occur in minutes and generally do not incur transaction fees.

Rising Star Checking

As kids get older, they need more hands-on experience in managing money - including tracking spending habits in online and mobile banking, setting savings goals, and learning when to make purchases using their debit card. With the Rising Star Checking Account, children as young as ten years old can be issued a debit card and have access to free Online and Mobile Banking services.

Teach them about money management and take advantage of these great perks:

- Rising Stars, ages 10-17¹, are eligible for this account

- CAMPUS Online & Mobile Banking with Mobile Deposit

- Early Pay - receive your paycheck up to 2 days sooner²

- Choose one of our four debit card designs³

- No fees or minimum balance required

1. Social Security Card and Birth Certificate are required to open the account. Rising Star (minor) is primary member, Adult Joint Owner required. Joint owner must be 18 years or older. Joint owner credit approval and a $5 opening deposit to a savings account is required. 2. Direct deposit paychecks made through ACH could be available up to two days before the scheduled payment date. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit. 3. For security reasons, there are limits on the number and amount of transactions.

Money Market Checking

At last, a Money Market Account you can use for Personal or Business.

The CAMPUS “Best-of-Market” Money Market Checking offers the added convenience of direct deposit, money transfers and even check writing, while earning higher dividends on your deposits.

- Best-of-Market Money Market Rates

- Unlimited check writing¹ and transfers

- Online Bill Pay

- CAMPUS Online & Mobile Banking

- Early Pay - receive your paycheck up to 2 days sooner²

- One free box of checks per year

- Financial Tools, in CAMPUS Online and Mobile Banking, a management tool to help you track spending, budgets, and set goals.

1. Best-of-Market Money Market Checking Accounts for businesses are limited to 20 deposits and 150 cleared checks per month. Account may not be available to all businesses. $15 fee if at any time balance falls below $10,000. 2. Direct deposit paychecks made through ACH could be available up to two days before the scheduled payment date. Early availability of direct deposits is not guaranteed and may vary from deposit to deposit.

Savings Club Accounts

A CAMPUS Club Account is the perfect way to save up for something special!

- Save for holiday shopping, a vacation...anything

- Earns slightly higher interest than a regular savings account

- No fees or minimum balance

- Choose to automatically deposit any amount from your paycheck each month

The club accounts pay out on a specified date (unless otherwise noted), just in time for holiday shopping or summer vacation. Your automatic deposits, if set up, will continue to deposit in your club account to start saving for the next year. Club accounts are the easiest way to save.

Certificate of Deposits

Enjoy a risk-free investment with a CAMPUS CD. The interest rate and annual percentage yield is fixed when the deposit is made and will remain in effect until the maturity date.

- Minimum balance is $2,000

- Terms of Maturity range from 91 days to 3 years

- Interest is paid monthly

- Best-of-Market CD Rates

Find a better rate at another financial institution? CAMPUS may be able to match or beat any local competitor!

CAMPUS Kids Savings Account

A new savings account for Kids 17 years old and under!¹

- Earn interest on every dollar up to $100,000²

- No monthly fees

- Unlimited withdrawals

1. A $5 initial deposit is required into a savings account. Birth Certificate and Social Security Card are required to open an account. Adult joint owner required. Joint owner must be 18 years or older. Joint owner credit approval required. 2. The annual percentage yield may change as determined by the Credit Union’s Board of Directors.

Individual Retirement Account

It’s never too early to start saving for retirement! CAMPUS IRAs offer benefits that make all the difference in retirement planning.

- Traditional IRA

- Roth IRA

Questions? Contact a CAMPUS IRA Specialist today!

Mobile Deposit

Mobile Deposit is a feature on the CAMPUS Mobile App. Eligible account holders may now quickly and conveniently deposit checks into their CAMPUS account using the camera on their smart phone.

- Save time and money. No more trips to the ATM, Service Center, or post office to mail in your deposits. Make deposits from home, or on-the-go!

- Simple and secure. Once you’re eligible for the service, Mobile Deposit will be an option on your CAMPUS Mobile App. Just take a picture of your check, choose the account, and the amount of your deposit and you’re done! Your check image and account information remains safe and secure on the CAMPUS Mobile App.

- Best of all – it’s FREE! There will be no charge for Mobile Deposits. Deposit your check without ever stepping foot in a CAMPUS Service Center!

*Contact your local service center to see if your business is eligible for mobile deposits.

Online Bill Pay

No more stamps. No more envelopes. And Online Bill Pay is FREE when you sign up for a CAMPUS Free Checking Account1 with eStatements!

Pay your bills online each month from within CAMPUS Online & Mobile Banking. It’s easy to sign up! (must be enrolled in CAMPUS Online Banking).

- Log in to your CAMPUS Online Banking account

- Hover the cursor over the header Bill Payment, then click on Pay Bills

- Select which suffix(es) to enroll and click Enroll

- Click Finish

Online Bill Pay is free with the CAMPUS Free Checking Account1 with electronic monthly statements, otherwise there is a $2.95 monthly fee.

1. Credit approval and initial $50 opening deposit is required. Member must elect to receive eStatements within the first 90 days.

Online & Mobile Banking

Free CAMPUS Online & Mobile Banking puts your finances at your fingertips. You can view your transaction history, check your balances, make transfers and loan payments all from your home computer or mobile device. You can also view your balances and transactions on your Apple Watch®.

Download the CAMPUS Mobile App on the App Store or Google Play today!

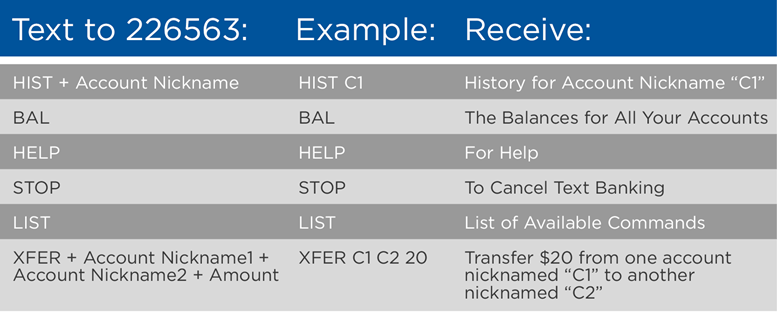

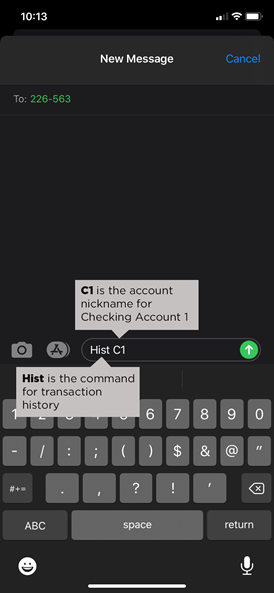

SMS (Text) Banking

Using a few simple commands, you can request your balances or account history be sent directly to your mobile device — just text the below command(s) to 226563.*

To sign up for text banking, just log in to CAMPUS Online Banking or the CAMPUS Mobile App and, under “Services,” click “Text Banking.” Follow the easy instructions to begin accessing your account via text messaging.

For example:

Type Hist (the command for transaction history) followed by an account nickname to view transaction history for your account.

*Messaging and data rates may apply.

Financial Tools

CAMPUS offers Financial Tools, a comprehensive way to manage your finances seamlessly. With Financial Tools, you can:

- View up-to-date balances and transactions across all your CAMPUS accounts and external accounts in one place.

- Create and track personalized budgets to better manage your expenses.

- Gain insights into your spending habits, cash flow, net worth, and debt management.

- Instantly categorize transactions with intuitive icons to see where your money goes.

Log in to CAMPUS Online & Mobile Banking to explore all that Financial Tools has to offer, and take control of your finances today!

Electronic Monthly Statements

Go Green! Sign-up to receive your monthly statement(s) electronically each month. It’s free, it’s easy…and you’ll save a tree! What’s more, you’ll get an email notification when your electronic statement is ready to view instead of having to wait around for the mail. You can print a paper copy of your statement if you like to file them away, or let CAMPUS store them for you for up to three years!

Send Money with Zelle®

Zelle® – a fast, safe and free¹ way to send money to friends, family and other people you trust¹, regardless of where they bank. Whether you’re gifting money or splitting the cost of a bill, Zelle® has you covered.

1. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes and generally do not incur transaction fees.

Mobile Wallet

You can use your CAMPUS Credit Card or CAMPUS Debit Card in your mobile wallet using Apple Pay™, Google Pay™, or Samsung Pay™.

Once you're enrolled, you can make purchases with a simple touch, either in apps or in stores with your mobile wallet at thousands of retailers nationwide!

It's the easy, secure way to pay for purchases with your mobile device.

When you complete a transaction using your CAMPUS debit or credit card Mastercard®

- Your name, card number, and security code stay private

- You don’t give your physical card to anyone

- Google Pay, Apple Pay, and Samsung Pay don't share your actual card numbers with retailers

- The retailer receives only a transaction-specific code to process your payment